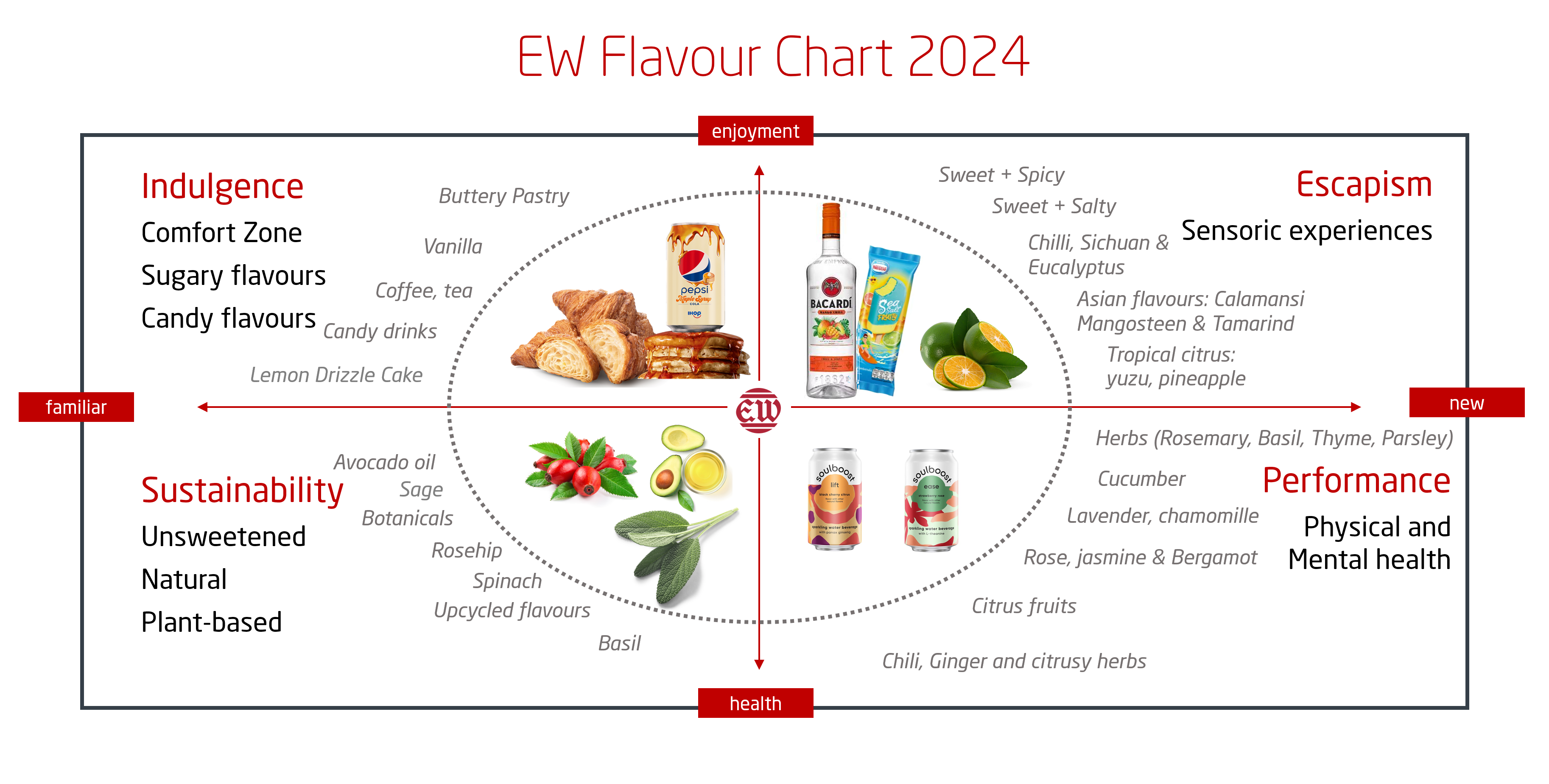

TREND WHEEL 2024

Healthy living

Performance

Everything we do must be beneficial for both body and mind. Consumers want something that will help them, and their bodies achieve their fitness goals more effectively. The products must be functional and help the consumer feel that they are doing something good for themselves. On the shelves, more and more low kcal versions are emerging, filled with natural caffeine, electrolytes and vitamins

Organic & Pure

Brands which offer one or more ESG claims on their products outperform other products, making none. Several data show that not only do brands with ESG focus win on sentiment and brand equity but also on revenue. However, some consumer segments with less spending power fail to turn good intentions into purchases.

Fuel my mood

We are looking for ingredients that can boost our mood and that can help us a lot in balancing a busy everyday life. As consumers are more fatigued and stressed out than ever before brands offer products to cater to that demand. From cognitive support to mental clarity and sleep aid.

ECO ECONOMIC

Our wallet size

Inflation, recession and raging wars have taken a toll on the global economy. The gap between the wealthiest and poorest is expanding. 39% of global consumers say they are in a worse financial position in 2023. As described previously, this means that e.g. Gen-Z consumers may have to choose between financial security and sustainability/healthy products.

Wallet shift

Economic hardships like recession and inflation have an influence on how we buy. In general consumers are more cautious and financially focused on their spendings. As we for the first time this century see global monthly wages decreasing we see wallet shifts.

Thrivers

For the FMCG sector this means less spending in on-trade channels i.e. dining/eating and takeaway and more on off-trade channels at which categories fresh produce, fresh meat, health & wellness and dairy has seen an increase on 36%. In the next years some categories will thrive and others will need to survive.

INDULGENCE

AND WHY IT IS STILL RELEVANT

Despite aiming to lead healthier lifestyle, demand for indulgent products remains high, creating opportunities for brands to elevate their indulgent attributes. Indulgence may even offer sensory experiences as a break from healthier, less tasteful products. Within the indulgence trend several microtrends have emerged to elevate the indulgence positioning. SWICY (Sweet and Spicy) trend has most recently gained momentum and is seen in everything from chocolate to flavoured spirits, RTD’s and even in McDonald’s Sundae icecreams.